THE SUNLIGHT TAX BLOG:

Tax and Money Education for Creative People, Freelancers and Solopreneurs

search A TOPIC

Categories

- Business Management 17

- Creative Specific 3

- Estimated Quarterly Taxes 5

- General Economy; Tax Policy and Legislation 37

- Get to know Hannah Cole 8

- Interviews and personal stories 23

- Personal Finance 17

- Personal and Career Development 16

- Practical and Tactical Tax 54

- Retirement and Future Success 26

- Sunlight Podcast 149

- Tax Deductions for Freelancers and Self-Employed 7

- the Sunlight Tax Podcast 6

What you need to know about the Child Tax Credit

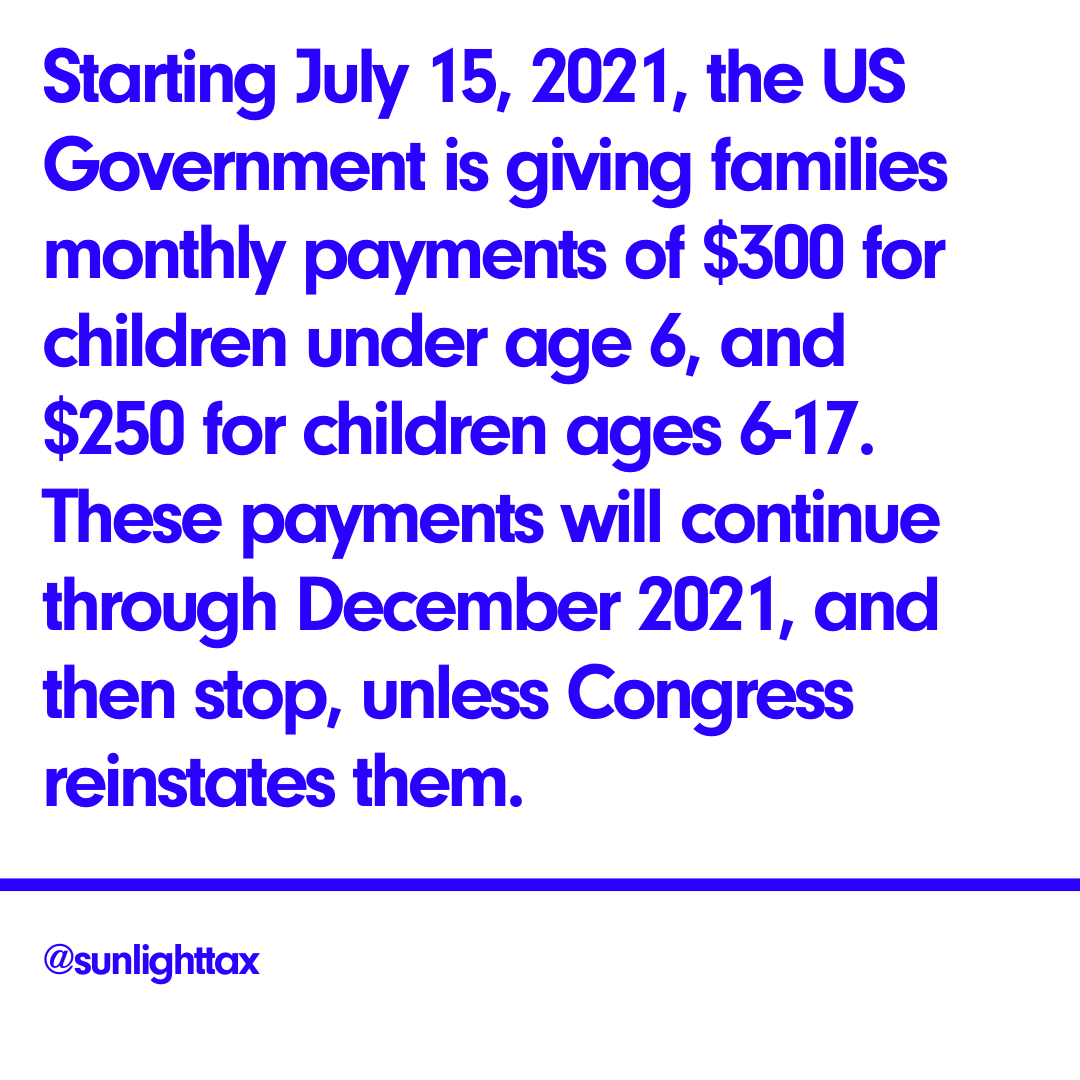

Starting July 15, 2021, the US Government is giving families monthly payments of $300 for children under age 6, and $250 for children ages 6-17. These payments will continue through December 2021, and then stop, unless Congress reinstates them.

So what are they?

Starting July 15, 2021, the US Government is giving families monthly payments of $300 for children under age 6, and $250 for children ages 6-17. These payments will continue through December 2021, and then stop, unless Congress reinstates them.

So what are they?

These payments are the result of an updated Child Tax Credit, expanded and revised by the Biden administration, and enacted in the March 2021 Biden stimulus bill. Before 2021, the Child Tax Credit was a refundable tax credit that--like most tax credits--was rolled into all your other credits at tax time, and delivered as a lump-sum reduction of your taxes, once per year at tax time. What the Biden administration did is threefold:

they expanded the amount of the credit--from $2000 per child under 17 to $3,600 per child under age 6 and $3,000 per child between ages 6-17, and

divided the credit up into monthly amounts, to be sent directly to families each month via direct deposit (or by check if you don’t have a bank account).

They also expanded eligibility for the credit, allowing all but the richest families to receive it (9 out of 10 families will get payments)

What you need to know

Money will be sent directly to your bank account by direct deposit starting Jul 15, 2021. The US Treasury will send money to the account listed on your tax return. If that is what you want, then no action is required. Families eligible for the credit are those with annual income less than $150,000 for married filing jointly, or under $112,500 for Head of Household (unmarried individuals with children). (Single filers with annual income under $75,000 are also eligible--although I’m still scratching my head about how these folks will actually be eligible, given that single filers without dependent children will not have children for whom to claim the credit). Families with higher incomes will be eligible for a reduced amount of the credit.

If you do not have bank account information listed on your last tax return, you will receive a paper check, mailed to the address listed on your tax return. If you’d like to receive direct deposit, you may enter your bank information at this IRS website. You can also use that site to check your eligibility for the credit.

What do you do if you don’t file a tax return and are eligible for the new Child Tax Credit monthly direct payments? You can sign up to receive the money at the IRS’s new non-filer sign up tool. This is important because many of the lowest-income people in the US do not file tax returns, and have therefore been ineligible for this and other tax credits in the past.

The expanded child tax credit is expected to have a huge impact on children in the US. It is predicted to lift 50% of children in the US out of poverty. Economic research shows that a monthly payment labelled “Child CTC” is more likely to be spent on the children it is meant to benefit than a lump-sum annual tax refund. And it will benefit 9 out of 10 families in the US. If you want the expanded child tax credit to continue past it’s expiration date of December 2021, be sure to let your members of Congress know.

Watch Hannah’s recent talks about the new child tax credit. If you have further questions about the credit, you can check out the IRS’ FAQ page for more information.

DISCLAIMER: True tax advice is a two-way conversation, and your accountant needs to hear your full situation to apply the rules correctly in your case. This post is meant for general information only. Please don’t act on this alone.

Hannah Cole is an artist and Enrolled Agent. She is the founder of Sunlight Tax.

You Need a Budget Podcast: Simplifying Taxes for Artists and Creative Professionals

I talked with Jesse Mecham at the You Need a Budget Podcast about the capabilities that creatives bring to the table, breaking the artist stereotype, and starting bookkeeping systems that work for you.

So shut down any misconceptions the world tells you about artists and money.

I talked with Jesse Mecham at the You Need a Budget Podcast about the capabilities that creatives bring to the table, breaking the artist stereotype, and starting bookkeeping systems that work for you.

Money Story: Grant Conversano: Invisible backstories, peer influence, and betting on yourself.

Grant Conversano (they/them) is a filmmaker. They graduated the UNC School of the Arts in film, and started Apple House Pictures with their brother, Adam Conversano. Apple House Pictures recently wrapped filming for Andrew Yang’s New York mayoral run. They currently live in New York City with their brother.

Grant Conversano (they/them) is a filmmaker. They graduated the UNC School of the Arts in film, and started Apple House Pictures with their brother, Adam Conversano. They currently live in New York City.

Hannah Cole: Who are you, what are your pronouns, and what do you do?

Grant Conversano: I’m Grant Conversano, I use they/he pronouns. My brother and I are filmmakers, from Concord NC, and I went to UNC School of the Arts in filmmaking. I’m living in Brooklyn with my brother, and we run a small production company. We produce commercials, documentaries, music videos and write our own creative projects and features. We recently wrapped commercial content for Andrew Yang’s mayoral campaign.

HC: What brought you to a place where you wanted to learn how to get your money stuff together?

GC: Before the pandemic, I had only anecdotal knowledge how to be a freelancer after art school. I only knew the basics from friends just out of school. Really, if I’m doing what they are doing, that’s fine, living paycheck to paycheck, scrambling, getting 1099s together at the end of the year.

I remember thinking “Oh I got a big tax refund,” like that’s a positive. But I remember that you said this, “if you don’t trust yourself with money all year long, then getting a refund is a way to save. But that is something to look at.”

During the pandemic, I was unemployed, and I needed to get income. Freelancers were newly eligible for unemployment. Stimulus checks were coming, and I knew I needed to get in the system as fast a s possible to keep things going. It was unclear how to do this. The tax code was changing, there was new money from the government, all on top of just entering my mid-20s. I went to Google, we found your website and we went from there.

My desire to get into your program was realizing how much the world was changing,I’m in my mid 20s, and I’m starting to look at the scope of life.

HC: Can you tell us about where you are coming from in your money story?

GC: We had a turbulent upbringing. Our father was a lifelong alcoholic, and had trouble holding down a job despite having a master’s degree. He has a lot of social mobility on one hand, but mixed with addiction, that really rocked our family for many years. The last job I remember him having, I was nearing the end of high school. He didn’t have a job the entire time I was in college. My mom was the single income of our family while there were a lot of student loans being taken out in my name. My brother followed behind. I didn’t have a sense of the implications of taking out loans to go to art school. I was young--17. In 2013, no one discussed what that meant. No one discussed that we might be signing up for a lifetime of debt.

My parents wanted the best for us. But getting out of school, the reality of student loans, the pressure of moving to a city like New York or LA, the class barriers became apparent very clearly. In school they were masked to a degree. I thought I was doing all the right things--taking internships at very prestigious places, being an assistant to people I have learned a lot from in the industry. It was absolutely unsustainable--I was incurring credit card debt on top of that. It caught up with me quickly because I wasn’t making enough to live on--close to nothing for people in the industry, even though it seems like that was what I was expected to do. All the signals said, “keep going down this road,” but at a certain point, the numbers weren’t working.

I read a book by the Duplass brothers. It was honest and practical in terms of life story, money, housing, what you really need to be thinking about. They are talking about film, but really life in any creative pursuit. How long it took--they couldn’t always be in the most expensive place--that isn’t what made their careers. Sometimes they were on the outskirts.

I moved back to North Carolina, my brother and I moved in together, a year before the pandemic. We talked about building something together - we were getting signals that we were making a mistake, doing the wrong thing to stay in North Carolina. But then the pandemic came along, and it felt like it really was the right decision. We would rather bet on ourselves than bet on the approval of some institution.

People really realized during the pandemic that they had to retreat and fend for themselves. It became clear who had bigger safety nets than others. We were still very fortunate to a relative degree. But the illusion that we are all in this together cracked.

We started building from there. Working from home, editing for other people, building up a portfolio, getting clients for ourselves. My brother dropped out of college and we started working. We started our own production company.

A lot of people in their 20s get a bunch of roommates and make that work. I didn’t want to do that anymore. There aren’t many boundaries between our work and life - we live together and work all the time.

HC: What have you learned from this experience?

GC: Reading about business in general, treating this work as work, and knowing it is a business, and that we need contracts. Knowing we need a system, and truthfully letting go of naive ideas we indulged in art school of the purity of film. It’s an expensive art form at its best, and most of the time you’re working with a lot of people. You need to have boundaries set in place to navigate that. Taking the business side of every job seriously. That was a choice at a certain point.

HC: Have you had any revelations?

GC: For the majority of us, our sense of self and of money is so wrapped up. It took a lot of work--therapy, and taking your course. They echoed each other. You have to take responsibility for your own life, actions, choices. At what age do I stop blaming my parents and take responsibility for myself? Not using the idea of being an artist as a defense in the tax code. As though knowing about taxes would make me less of an artist.

I think a part of it is our culture. The mega-successful artists - the image that is put out there is that they don’t talk about the other things. It penetrates some illusion that people arrived at all this success on their own, and without business savvy or skills. But if you peek behind any story of how someone made it somewhere, there was a lot of help involved. Do people publicly acknowledge that? Or do they let people believe they magically arrived there?

I think even for instance, I did get into investing before all this. I naively downloaded Robinhood. I wasn’t putting serious money into it, but was interested in understanding investments. The Gamestop moment was really interesting. Part of me was like, whoa, what if I put more money in? I know that is about as close to gambling as you're going to get. Building for sustainability is an important transition I’m making. Your course on long term investment strategies was helpful in thinking in decades, not just in moments.

It’s weird because, ultimately, you just gotta put your faith somewhere. There’s a lot--it’s not clear what’s going to happen next.

Everyone’s story is different even if you think your peers and you are in the same world, the same school, the same party. Everyone is different. Everyone is coming from a different place. Most of my life, most people didn’t know about the alcohol or dysfunction in our life. That just looked like “I’m not eating lunch today.” Trying to fake it because of the insecurity. Owning that. Owning, “well, this is the insecurity, and we’re just starting here.” I’m actually taking steps from where I come from, and that can be true for anybody. Owning where you’re at without shame. This is where I’m starting from.

I had to get over whatever shame I had about money to even call you. That was a big step--asking for help. And that is usually when things start to look better. It’s like, “Hey, I have Google, I’m not alone, I can see what happens.”

Having the gumption to push past certain fear. Some people can walk back to their parents’ house, and we couldn't. So we were just like, “I guess I’m just gonna plow ahead.”

ReverseCyclopedia Podcast - They Have A Word For That: Felony

I did a super fun COMEDY podcast about taxes (weird, right? But it's true) for the new pod ReverseCyclopedia.

We talk about money weirdness, tax misconceptions, and how I'm 95% Sunlight and 5% Dominatrix.

So don't buy that old economics bulls**t that money is neutral.

I did a super fun COMEDY podcast about taxes (weird, right? But it's true) for the new pod ReverseCyclopedia.

We talk about money weirdness, tax misconceptions, and how I'm 95% Sunlight and 5% Dominatrix.

Take a listen below.

WTF is an NFT?

WHY THIS PROJECT, AND WHY NOW?

Sales of digital art via NFTs are exploding right now, and it's simultaneously a new model for the art world--raising questions about the environment, our relationship to gatekeepers, resale rights and more, and new terrain in the area of money itself.

This feels like rich territory to explore and to shed light on the issues to the Sunlight Tax Community. Also it’s complicated and confusing, and we can help.

WHO’S INVOLVED?

Hannah Cole: artist, tax expert/educator and Founder of Sunlight Tax.

Aubrey Holland: programmer, woodworker, wearer of dad-hats, Hannah's partner.

You: Your questions will shape this project, and you might get to own one of the NFTs we create.

SOME BASIC INFO: WHAT IS AN NFT?

It’s a non-fungible token, which means that as opposed to being interchangeable with any similar token (like a dollar bill) these are unique in the world. That sounds confusing, but I’ll argue that the Mona Lisa is a non-fungible token.

Why this project, and why now?

Sales of digital art via NFTs are exploding right now, and it's simultaneously a new model for the art world--raising questions about the environment, our relationship to gatekeepers, resale rights and more, and new terrain in the area of money itself.

This feels like rich territory to explore and to shed light on the issues to the Sunlight Tax Community. Also it’s complicated and confusing, and we can help.

Who’s involved?

Hannah Cole: artist, tax expert/educator and Founder of Sunlight Tax.

Aubrey Holland: programmer, woodworker, wearer of dad-hats, Hannah's partner.

You: Your questions will shape this project, and you might get to own one of the NFTs we create.

Some basic info: What is an NFT?

It’s a non-fungible token, which means that as opposed to being interchangeable with any similar token (like a dollar bill) these are unique in the world. That sounds confusing, but I’ll argue that the Mona Lisa is a non-fungible token.

There is exactly one real Mona Lisa and it is owned by the Louvre, but I can put a print of it on my wall and receive many of the same benefits as the owner minus the crucial ability to sell it and the pride (and rights) of ownership.

Here's where you come in. We're building and selling an NFT series to learn about how they work. Your questions will shape this project.

So tell us: what do you want to know about NFTs?

Part 2: NFTs and the Environment

NFTs in the art world operate on blockchains (secure, digital records of transactions that are decentralized, unchangeable and virtually unhackable), primarily one called Ethereum.

Ethereum is a decentralized currency that exists online. Through a process called mining, computers maintain the currency by solving increasingly complex problems and are rewarded with bits of the currency. The computations required to solve these problems consume a vast amount of energy.

Ethereum alone is currently producing as much carbon as Lebanon, and a single transaction requires enough energy to power the average US household for three days (and Bitcoin is much worse). There is reasonable debate about how much NFTs specifically contribute to this, but it’s bad news regardless.

Fortunately, there are other types of blockchains that use dramatically less energy. Tezos is a proof of stake chain that uses less energy than Ethereum by a factor of two million and supports NFTs. Transactions on Tezos can be compared with swiping your credit card or writing a tweet from a carbon standpoint.

Minting NFTs on Tezos is also much cheaper, costing around $0.25, compared with up to $100 on Ethereum, so getting started with it is much more accessible. And Tezos is just one example, there are many other blockchains that support NFTs, and they are growing.

On the other hand, the art marketplace on these alternative chains is just getting started. Tezos has a platform called hic et nunc, and NFT Showroom also looks promising, but neither is all that approachable or easy to use. We’ll be looking at marketplaces and how to use them in our next post in the series. What questions do you have about NFTs and energy consumption? About the alternatives? About what it will take to get the art world operating on sustainable blockchain platforms?

Thanks to Aubrey Holland for major writing and research of this post.

What are your money concerns?

Suggest a blog topic for Hannah here.