GUIDED BOOKKEEPING WORK SESSION

Money Bootcamp

Designed for creators: artists, bloggers, dancers, entertainers, designers and freelancers.

Imagine what it would feel like to:

have an artist/freelance tax expert guide you through your taxes, so you finally understand them

get fast focus on the things you need to know, led by an artist who gets you

get concise, targeted, monthly money checklists in your inbox

get monthly video walkthroughs & guide to key concepts

know the deduction rules really well, so you can take full advantage

know you were tracking the right things in your books

develop systems for staying on top of your money

understand the classic audit triggers for artists

Your creative practice is gaining steam: you just got a big grant, a big show, or a big client. You’re excited to get to work and make this your best year ever.

But a nagging feeling tells you there are tax implications and financial best practices you should consider. You hate the thought of getting bogged down in tax research and financial literacy, but what you don’t know might be holding you back.

You just want to get in the studio and do the work you love.

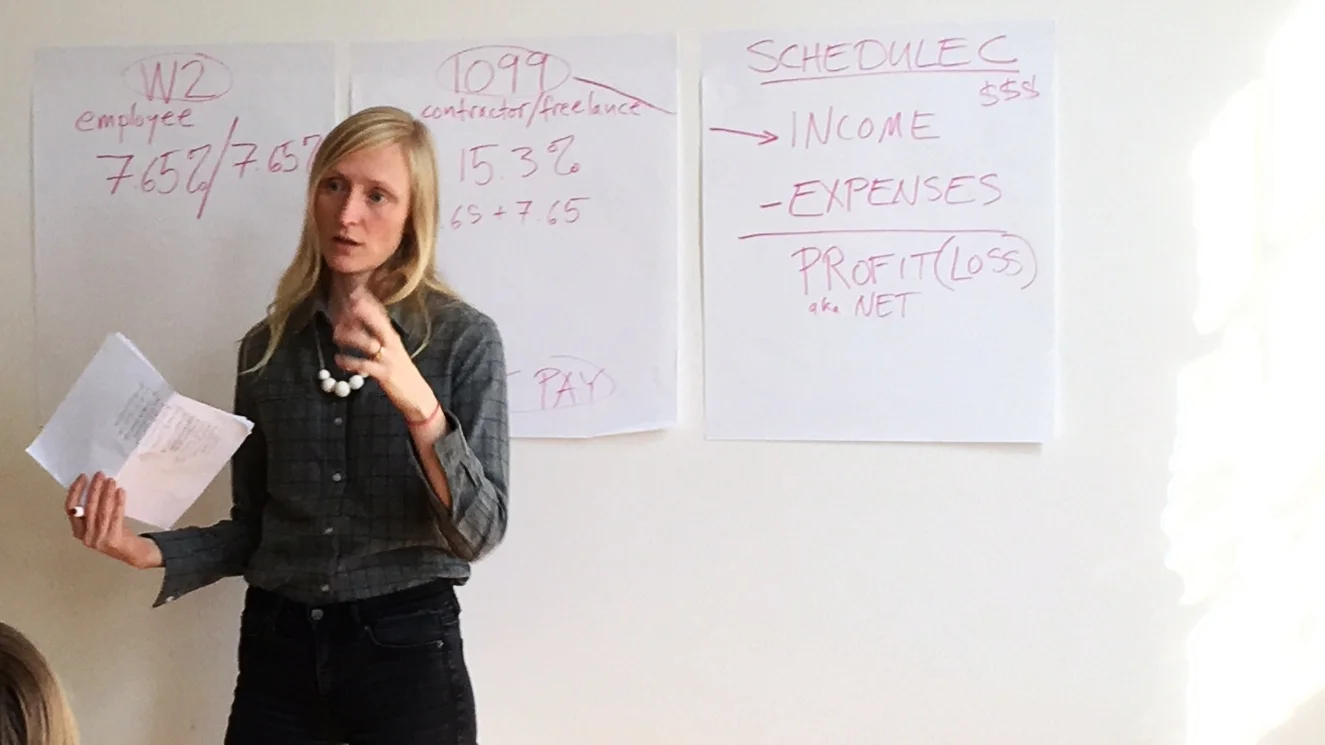

What is Money Bootcamp?

Money Bootcamp is an annual membership, with online learning, quarterly worksessions, and a simple spreadsheet bookkeeping system you will learn to use and get to keep, to get you set up right and tracking all the right things without wasting your time. Your guide is a tax expert who is also an artist like you, but with tons of insight about the financial side of the creative world, and what the IRS is looking for.

Money Bootcamp teaches you basic financial skills and tax savvy so you not only stop spending unnecessary time tracking the wrong things, but so you get organized, get set up on a system that works and get the knowledge you need to feel savvy about your finances. It’s a guided, self-motivated path to fixing your tax and financial life, and taking advantage of all the tax shelters, deductions and incentives. It’s designed to give you maximum artworld-specific empowerment at a group learning price.

It includes preparation of your personal income tax return (optional).

Money Bootcamp is an investment in your long-term financial stability. The cost (and course) is spread over the full year to help your cash flow, and yes, it is deductible on your freelance taxes.*

30 minute one-on-one coaching

Monthly webinars on targeted, artist-specific areas, including:

Setting Up Your Year for Taxes

Artist Deductions Deep Dive: What, How, When, Why.

Bulletproof Your Arts Business: Artist Audits, Hobby/Loss and the IRS

Making Your Business Official: Legal and Accounting Steps

Bookkeeping For Tax Savings, with QuickBooks Self-Employed Tutorial

Investing to Grow Your Wealth: How, Why, and Tips to Keep it Simple

Habits to Get You There

Save Like a Millionaire: Tax Shelter 101

BONUS: 1099s: Tracking, Collecting, and How to Issue them Yourself

Self-guided bookkeeping setup

Monthly money checklists in your inbox

Video walkthroughs & guide to key concepts

Full access to video library

*if you have a business with a profit motive, not a hobby.

Money Bootcamp is here for you

Designed for your busy creative life, and led by an empathetic artist/accountant it will steer you toward better habits and longer term planning, without wasting your time.

Hannah Cole has spent 4 years surveying creative people like you to design a program that delivers a year of top-notch, creative-mind-oriented accounting knowledge at a fraction of the price of hourly accounting. And it even includes getting your taxes done.

12 in-depth money trainings tailored to creative people

Spreadsheet bookkeeping system, with in-depth training

Quarterly bookkeeping worksessions

In-depth training on calculating your quarterly taxes

Monthly accountability checklists

Personal goal-setting w/check-ins for accountability

Full access to video library

Private Facebook group for your questions

Optional 30 minute one-on-one coaching session (additional fee)

Everything in DIY Bootcamp plus…

Guaranteed spot on my tax calendar* (see fine print at bottom)

Your tax filing (1040 personal income taxes including your Schedule C business, plus your spouse, two-for-one inclusion of your spouse, if you file jointly, which includes:

Two-for-one inclusion of your spouse, if you file jointly

Personalized tax projection

Setup of estimated quarterly tax payment amounts for the next year

Personalized IRA guidance

Personalized guidance on losses in your Schedule C creative business

“I walked away from this tax season with a better understanding of my business because Hannah made the process a learning experience. She guided me through the steps of filing and made sure that I understood every aspect of what we were doing. She took the time to speak to me over the phone to go over areas that I didn’t understand and introduced new practices to insure more success for my growing business.”

“I’ve really grown from simply getting a better understanding of how being self-employed works in terms of taxes, the requirements of tracking and claiming expenses and income, and knowing how critical it is to have an actual system in place for all these things. Having a clearer understanding of what’s an expense, and knowing I have Sunlight Tax on my side to help me figure out the unclear parts of the ongoing process. I love that Bootcamp is truly holistic, in that you don’t just learn how to track how much you’ll owe for taxes, but you learn how to manage your books, develop a savings and retirement plan, and take advantage of all the benefits possible along the way.”

About Your Instructor

I’m Hannah and I’ve been a working artist for over 15 years. And everything good that has happened in my art career has come from my fellow artists.

I started Sunlight Tax to give back to the creative community that has nurtured me. When artists stop making work, the reason is usually financial.

In this era of mistrust and breakdown, artists have work to do - we’re the ones who create connections, bridge divides, inspire people and call them to action, and we help people envision a world as it could be.

So when I’m able to give other creative people the money tools they need to be financially stable, I’m supporting your important work. I’m here to say that the world needs you right now.

But also: You need a retirement fund. My mission is to give you the financial security tools you need to take big risks and kick ass.

I’m an Enrolled Agent, a tax expert, a speaker, and a writer. And of course, an artist.

I’m a tax and money columnist for Hyperallergic, and formerly for Art F City. And these are some of the arts organizations that have hosted me:

FAQs:

Q: I don’t need you to do my taxes. Can I still get the coaching, checklists and webinars?

A: Yes! You can join Bootcamp without the taxes.

Q: My spouse also does creative freelance work. Can they join?

A: Spouses can join for free, if you’re married filing jointly. They are welcome to join all webinars and join in on the tax and coaching calls. So married creatives basically get a 2-for-1 deal.

The fine print:

Your Bootcamp enrollment (tax version) includes your individual 1040 tax filing, and your individual state filing. This includes your spouse if you file Married Filing Jointly. It includes your Schedule C Profit or Loss from Business Activities.

Some situations I do not cover/Bootcamp does not include:

- No international tax situations (besides FBAR filing)

- No separate corporate tax returns (meaning S Corporations, Partnerships or C Corporations). Note that if you have an LLC, this does not mean you have a separate corporate tax return, and as long as you file on a Schedule C, I am able (& happy) to do your taxes.

- If your taxes involve extra complexity, I reserve the right to charge you for the additional time it takes to complete your return. This is very rare, (generally your individual taxes are fully included in the Bootcamp cost) but if your tax return has cost you over $700 in the past, or you have excessive brokerage transactions or cryptocurrency transactions, or complex/multiple real estate transactions, or other unusual circumstances, you may be in this camp.

- If I discover that I am unable to do your tax return once you are in Bootcamp, I will refund you the tax portion, and can file an extension for you if you need it.

- Uncooperative spouse: If you file a joint return, this means your spouse is included in our tax work together, and it is your responsibility to communicate with them & obtain their consent that Sunlight Tax is preparing the tax filing. Obtaining the cooperation of your spouse, including the uploading of their documents, and inclusion of their required tax information on my tax organizer is your responsibility. In the event of an uncooperative spouse, given that I have alloted a limited space in my practice for your joint return, I reserve the right to continue the full Bootcamp Plus Taxes charge for the duration of the 12 month period. No refunds for uncooperative spouses.

- Artists are beloved to me, and are almost always kind, respectful and treat our work together with the professionalism and mutual respect that it deserves. But on those very rare occasions when a client fails to uphold their side of our agreement by failing to communicate, deliver requested work documents on time or with the necessary communication, attempts to evade tax laws that I am duty-bound to uphold, or becomes unprofessional or abusive, I reserve the right to terminate the relationship immediately.

All Bootcamp clients must use their coaching time before their 12 month subscription period ends, or forfeit it. I will send a few reminders during the year, but it’s your responsibility to schedule the booking. Bootcampers getting their taxes done with me should know that the tax preparation process involves coaching, so you’ll get a lot of your questions answered during that time. You will find that it’s nice to schedule your coaching call with me later in the year, when new questions come up for you.

All coaching calls take place outside of tax season (February 1-April 20).