CHECKLIST QUICKGUIDE

SUBSCRIPTION

Gets you on track fast each month, so you can get back to making brave work.

Signup Deadline is September 30

You Get:

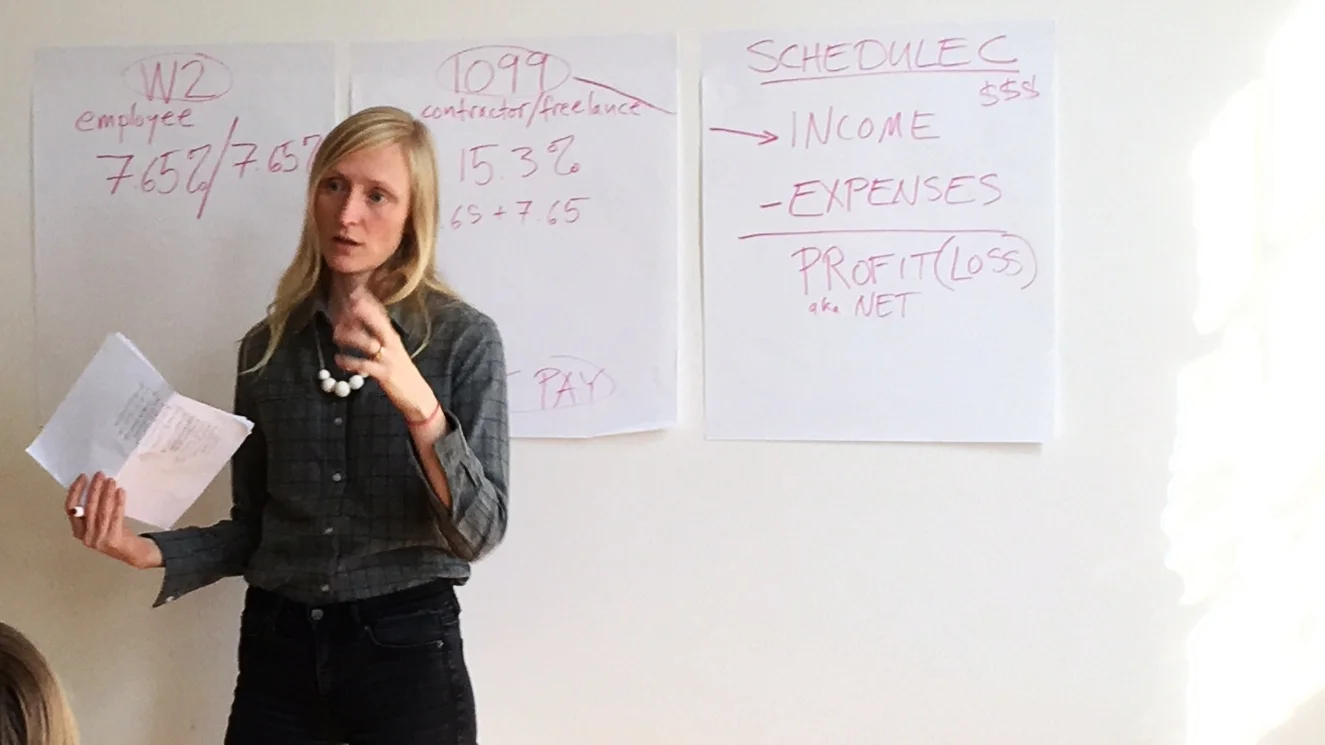

fast focus on the things you need to know, led by an artist who gets you

concise, targeted, monthly money checklists

monthly video walkthrough & guide to key concepts

25% off all Sunlight Tax School courses while enrolled, so you can dive deeper for less

$5 per month, or $50 paid in full for one year.

Your creative practice is gaining steam: you just got a big grant, a big show, or a big client. You’re excited to get to work and make this your best year ever. But a nagging feeling tells you there are tax implications and financial best practices you should consider. You hate the thought of getting bogged down in tax research and financial literacy, but what you don’t know might be holding you back. You just want to get in the studio and do the work you love.

The Checklist Quickguide Subscription is here for you.

It’s a concise monthly checklist with a video walkthrough, delivered to your inbox, to show you what to focus on to get your money straight. Designed for your busy creative life, and led by an empathetic artist/accountant it will steer you toward better habits and longer term planning, without wasting your time.

A sample of Checklist Quickguide topics:

December: key year-end tax planning tips

January: set up your tax year systems

Hiring a contractor best practices checklist

What to consider (taxwise) when you get a grant checklist

What to do with the money in your IRA checklist

Cash flow checklist: planning for tax day so you can keep more money

Money mindset checklist: are you chronically underpricing yourself?

And as a bonus, all subscribers to the Checklist Quickguide get 25% off Sunlight Tax School courses while enrolled. This way, when you know you need a deeper dive into a money topic, it’s easy for you.

The moment I started

my new business I started to dread tax season. I had little understanding about self-employment tax and had no idea who I should turn to. I am beyond grateful that I found Hannah Cole of Sunlight Tax. Her services are fast, organized and super painless. I consider myself more of an artist than a business person and with Hannah’s niche understanding of the arts and of creative businesses I totally felt at ease working with her. I walked away from this tax season with a better understanding of my business because she made the process a learning experience. She guided me through the steps of filing and made sure that I understood every aspect of what we were doing. She took the time to speak to me over the phone to go over areas that I didn’t understand and introduced new practices to insure more success for my growing business. I really can’t rave about Hannah’s services enough, I have already recommended her to friends.

— Emma Marty, designer/jeweler, Washington DC

Signup deadline is september 30.

Hi, I’m Hannah.

I’ve been a working artist for over 15 years. And everything good that has happened in my art career has come from my fellow artists. I started Sunlight Tax to give back to the creative community that has nurtured me. When artists stop making work, the reason is usually financial. In this era of mistrust and breakdown, artists have work to do - we’re the ones who create connections, bridge divides, inspire people and call them to action, and we help people envision a world as it could be. So when I’m able to give you the money tools you need to be financially stable, I’m supporting your critical work. I’m here to say that the world needs you right now. But also: You need a retirement fund. My mission is to give you the financial security tools you need to take big risks and kick ass.

I’m an Enrolled Agent, a tax expert, a speaker, and a writer. And of course, an artist.

I’m a tax and money columnist for Hyperallergic, and formerly for Art F City. And these are some of the arts organizations that have hosted me:

The Checklist Quickguide Subscription Cost:

$5 per month, or $50 paid in full for one year.

It’s an affordable investment in your career. And yes, it is deductible on your freelance taxes.*

Signup deadline is september 30.

*if you have a bona fide profit motive